Following two positive years for global developed credit markets, 2025 is anticipated to sustain this positive trajectory, driven by a combination of conditions:

- Favourable economic environment: a blend of robust economic activity, inflation stabilization, and a transition towards more accommodative monetary policies in both the US and the Eurozone;

- Strong corporate fundamentals: companies have capitalized on low interest rates in the post-pandemic era to improve their credit profiles. In the US, default rates are projected to remain near their historical average;

- Supportive technical factors: strong demand for corporate credit from income investors seeking to secure the attractive current levels before central banks implement further rate cuts.

However, it is important to acknowledge that some uncertainties, and related risks, still persist.

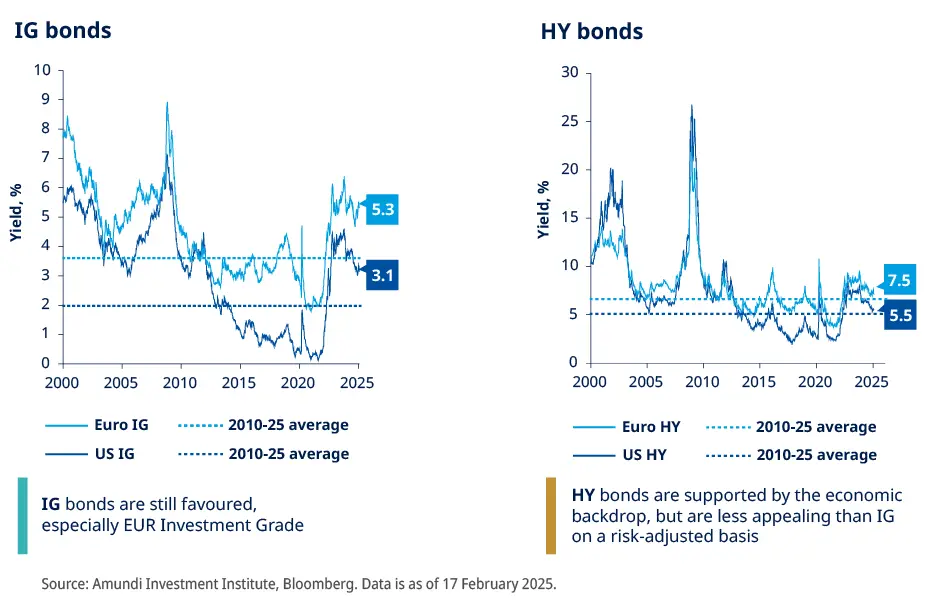

Credit remains attractive despite recent solid performance

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 4 March 2025. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 4 March 2025

Doc ID: 4288986